Market Value of Debt

Content

They also use the market value of debt to determine the enterprise value of the company. Fair value can refer to the agreed price between buyer and seller or the estimated worth of assets and liabilities. Although investors have many metrics for determining the valuation of a company’s stock, two of the most commonly used are book value and market value. Both valuations can be helpful in calculating whether a stock is fairly valued, overvalued, or undervalued. In this article, we’ll delve into the differences between the two and how they are used by investors and analysts. For example, real estate owned by a company may gain in market value at times, while its old machinery can lose value in the market because of technological advancements.

What is book value and how is it calculated?

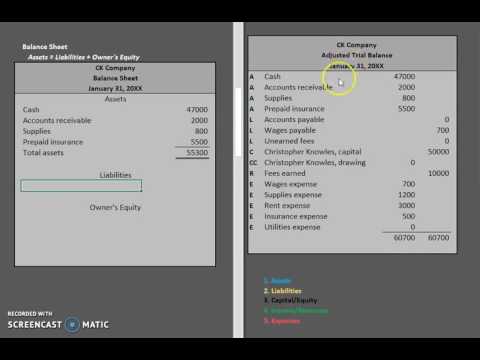

As mentioned earlier, book value is the difference between a company's total assets and liabilities based on its balance sheet. You can use the below formula to calculate the book value. Book Value = Total Assets – Total Liabilities.

Moreover, it doesn’t account for how a firm’s assets will generate profits and growth over time. Therefore, the market value, which takes into consideration all of these things, will generally be higher. Net Debt Of The CompanyDebt minus cash and cash equivalents equals net debt, which is the amount of debt a company has in comparison to its liquid assets.

Establishing a Sound Debt Policy

Closely related to leveraging, the Book Value of Debt is also known as risk, gearing or leverage. The key words are long term – we implicitly assume that the rolled over cost of short term debt converges on the long term rate- and today – we really don’t care about what rate the firm borrowed at in the past . A company’s pre-tax cost of debt can and will change over time as riskfree rates, default spreads and even the tax rate change over time. We are trying to estimate one consolidated cost of debt for all of the debt in the firm. If a firm has senior and subordinated debt outstanding, the former will have a lower interest rate and default risk than the former, but you would like to estimate one cost of debt for all of the debt outstanding. Balance SheetA balance sheet is one of the financial statements of a company that presents the shareholders’ equity, liabilities, and assets of the company at a specific point in time. It is based on the accounting equation that states that the sum of the total liabilities and the owner’s capital equals the total assets of the company.

- That is why, in stable growth, we assume that the capital base increases in lock-step with the operating income .

- Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling.

- Measures the average tax rate paid across all of the income generated by a firm.

The methodologies proposed are the use of https://personal-accounting.org/, a target capital structure which presumably would be the optimal and the use of the industry average capital structure, assuming that it also would be the optimal. All of these approaches have controversial issues and yield some mathematical inconsistencies.

Price-to-Book Ratio

It will allow you to adjust any numbers and add or subtract weighted average maturities. And, now we can determine the weighted average maturity of the debt by looking at the debt by maturity dates and dividing those by the total debt to find the weighting. Let’s assume a company has $1 million in market debt on the balance sheet, with interest expenses of $60 million and a maturity of 6 years, with a current cost of debt of 7.5%. The book value of an asset refers to its cost minus depreciation over time.

- When the market value of a company is less than its book value, it may mean that investors have lost confidence in the company.

- It is a problematic measure of leverage, because an increase in non-financial liabilities reduces this ratio.

- In practical terms, the debt to capital ratio is used in computing the cost of capital and the debt to equity to lever betas.

- And, obviously, liquidity constraints can lead to altered operating and product-market strategies that, in turn, may reduce a company’s market value.

- If a money losing company is computing its after-tax cost of debt, the marginal tax rate for the next year and the near-term can be zero.

With state and local taxes added on, this number will increase (to 38-40%). For companies operating in multiple countries, we can use one of two approximations. One is to assume that income will eventually have to make its way to the company’s domicile and use the marginal tax rate for the country in which the company is incorporated. The other is to use a weighted average tax rate, with the weights based on operating income in each country, of the marginal tax rates. Market Capitalization Estimated market value of shares outstanding, obtained by multiplying the number of shares outstanding by the share price. When a firm has non-traded or multiple clssses of shares, the market capitalization should include the value of all shares and not just the most liquid class of shares. Market Debt Ratio See Debt Ratio Market value of equity Market value of common shares outstanding + Market value of other equity claims on the firm Market’s estimate of what the equity in a firm is worth.